Uncovering the Chinese Purchasers of Iranian Oil [UPDATED April 1, 2024]

China is principally responsible for keeping the Iranian regime in business through oil purchases that have totaled over $90 billion since President Biden assumed office in January 2021 to December 2023. Four in every five barrels of exported Iranian oil go to China. This is despite U.S. sanctions that were reimposed in 2019 and maintained under the present administration, with the stated aim of reducing Iranian oil exports to zero. China has proven the savior of Tehran by continuing to import millions of barrels of oil every single day, and imports have likely even exceeded those made when the trade was not subject to U.S. sanctions.

While UANI has pinpointed more than 300 foreign oil-carrying “Ghost Armada” ships facilitating the trade, it has been difficult to identify the specific buyers. However, UANI obtained documentation offering major insights into the demand side of this illicit and uniquely lucrative trade. This resource provides granular and regularly updated information on the Chinese purchasers of Iran’s oil.

The Purchasers

Data received and reviewed by UANI shows that Iranian oil is being imported by China’s officially non-state, semi-independent “teapot” petrochemical refiners. Teapots were originally permitted to import crude, subject to centrally imposed quotas, starting in July 2015. Since then, China’s economic planning agency, the National Development and Reform Commission (NDRC), has granted tens of new licenses annually. Estimates of the number of teapots hover around 150.

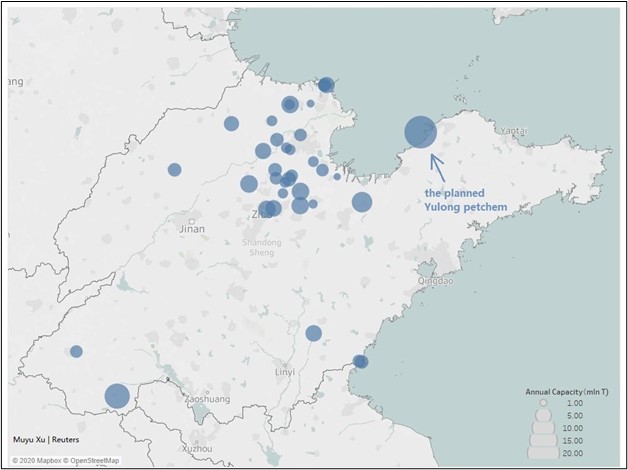

Today, the teapots import approximately one-fifth of all China’s oil needs. Around 70% of China’s teapot oil processing takes place in the eastern coastal province of Shandong, south of Beijing and north of Shanghai. For Iranian oil purchases, the teapots manage to buy at steep discounts—at least $4 a barrel below benchmark Brent. The Iranian origin of oil is also concealed by rebranding as either Omani Crude, Iraqi Crude, Russian Urals, Bitumen Blend, Nemina, or Malaysian Blend.

The fact that teapots—rather than major state actors—are importing the bulk of Iranian oil makes sense from China’s perspective. Since the U.S. has, in fact, sanctioned Chinese state-owned imports in the past, such as Zhuhai Zhenrong, the decision to import Iranian oil via dozens of small, unaffiliated “non-state” firms helps obscure the Chinese government’s role and protect its own big firms from scrutiny, accountability, and attendant sanctions. By contrast, with their small size and limited business operations, teapots are both hard to uncover and not exposed to the U.S. financial system. In conjunction with the lack of U.S. enforcement, the threat of sanctions is, therefore, far less of a constraining factor.

Available data - through March 2024 - shows the top teapot refinery purchasing Iranian crude is Qingdao-based Lawen Namu Petroleum Trading Co. Ltd. (Lawen Namu). Lawen Namu received at least 29 different shipments of Iranian crude oil, branded as crude, Oman crude, or Nemina. Together these shipments totaled approximately 39 million barrels of Iranian oil. UANI wrote to Lawen Namu in February 2023.

Lawen Namu is a trading company based at the key port of Qingdao in Shandong province. In January 2021, S&P Global noted that Lawen Namu’s oil imports had “jumped 212%” from the previous month, while it classified most of its imports as “blended grades” from Oman, West Africa, and Russia.”

The second biggest teapot importer is Shangang Guomao, which has received 20 different shipments of Iranian crude oil, branded as “Crude, Forties, Malaysia or Bitumen Blend.” Together these shipments have totaled more than 33.5 million barrels of Iranian oil. Kedama, which appears to be formally identified as Qingdao Kedama Energy Trading Co. Ltd, is third. Founded in June 2022, Kedama is a relative newcomer to Shandong’s burgeoning petrochemical trading scene.

Fourth is Shandong Dongfang Hualong Industry & Trade Group Co Ltd. (Hualong). Hualong has received at least 25 shipments of Iranian crude branded as Urals, Mal Blend, Oman or Blue Laser. Together these shipments totaled more than 26.7 million barrels of Iranian oil.

Fifth on our list is Shandong Shengxing Chemical Co., Ltd. (Shandong Shengxing), located on the northern coast of Shandong province. According to Global Trade Alert, Shandong Shengxing was granted its import license on May 23, 2018, perhaps not coincidentally, just two weeks after President Trump announced the U.S. withdrawal from the Iran nuclear deal (JCPOA). Shengxing has received at least 28 different shipments of Iranian crude, branded as Oman crude, and Iraqi crude oil. Together these shipments totaled approximately 26.3 million barrels of Iranian oil. UANI wrote to Shandong Shengxing in February 2023.

In addition to documentation obtained by UANI, the Wikiran website cites a further six teapot refineries - Lihuayi Lijin Refining & Chemical Co. Ltd Shandong Tianhong Chemical Co. Ltd Henan Fengli Petro-Chemical Co. Ltd Shandong Kenli Petrochemical Co. Ltd Qirun Group Co. Ltd Dongying Lianhe Petrochemical Group Co. Ltd. (Fuhai Group) – reportedly accounting for a monthly delivery of four million barrels over a one year period and in apparent collaboration with the Turkish energy giant, ASB Group. The full table of teapot refiners importing Iranian oil is listed in descending order from largest importer by barrels below. UANI will continue to update this chart as we receive more information on the purchasers of Iranian oil in China [Table Updated March 28, 2024]

|

Refinery |

Number of Shipments |

Branded/Rebranded As |

# of Barrels |

Vessels Involved |

|

LAWEN NAMU |

29 |

Crude, Oman and Nemina |

39,785,151

|

FENG TAI, HERA 1, HECATE, ANTHEA, MEMPHIS, ALANA, BOREAS, ELSA, NEREIDES, RHEA, ACHELOUS, FJORD SEAL, SAKARYA |

|

SHANGANG GUOMAO |

20 |

Crude, Forties, Malaysia and Bitumen Blend |

33,590,557 |

GLORY FOREVER, ELOISE (EX: SIMBA), ANSHUN II, CARINA V, PROGRESS V, BREEZE V, PHOENIX I, TITAN, ASTERIX, ROMA, YANNIS, LYDIA II, FIONA, LEONOR |

|

KEDAMA |

19 |

Nemina and Mal Blend |

27,091,189 |

HERA 1, MEMPHIS, FENG TAI, TIMMIUS, ELSA, ACHELOUS, ANTHEA, LYDIA II, NEREIDES, PRATIKA, RHEA |

|

HUALONG |

25 |

Urals, Mal Blend, Oman and Blue Laser |

26,771,522 |

SPIRIT OF CASPER, PHOENIX I, ELOISE (EX: SIMBA), ALTUS, LEOPARD, IVY, PRADA , BERG 1, YONG XING SHUN HANG, ANNICK, ROMA, AYDEN, GALAXY STAR, LUNA LAKE, YANNIS, RIQUEZA |

|

SHANDONG SHENGXING |

28 |

Oman, Iraq, Bitumen Blend and Mal Blend |

26,288,971 |

MARTINA, VORAS,ANASTASIA I, CHOLA QUEEN, AVENTUS I, BERG 1, REMY, BRAVA LAKE, ALTUS, NS CREATION, RANI, NYANTARA,PANDORA, EVERSHINE, AYDEN, OTARIA, GALAXY STAR, PUTRI SAMUDRA, MARIANNE |

|

QIHANG YUANYANG/QIHANG ENERGY |

16 |

Fujairah and Mal Blend |

24,377,206 |

PENTA I, UZOR, TIMIMUS, CATHAY PHOENIX, VETER, ELVA, TREND, IRISES, NIERUS, ARTURA, CATHAY KIRIN, PRADA, |

|

XINTAI |

22 |

Malaysia, Nemina, Bitumen Blend, ESPO, Oman and Fuel Oil |

19,377,648 |

CHOLA QUEEN, MARTINA, RANI, BRIGHT SONIA, SPIRIT OF CASPER, ANASTASIA I, SHANAYE QUEEN, AVENTUS I, BRAVA LAKE, PANDORA, EVERSHINE, OCEAN HERMANA, GLORY FOREVER |

|

JINCHENG |

11 |

Oman, Bitumen Blend, Mosa, and Crude |

19,068,216 |

ASTERIX, TIBURTINA, CARINA V, LIANA, MONOCEROS, NATALINA 7, SELENE, CATHAY PHOENIX, PHONIX, LUNA PRIME, LADY SOFIA |

|

GEA |

11 |

Mal Blend and Nemina |

14,597,216 |

EMILIA, LADY SOFIA, AFRODITA I, PENTA I, ALTUS, REX 1, JOLIE, BLISSFUL SEA, SPAR |

|

SHENCHI |

14 |

Mal Blend |

13,895,535 |

BRIGHT SONIA, PRADA, DOLPHIN, INNOVA, SPIRIT OF CASPER, QUEEN SERE, VOLANS, ELVA, GALAXY STAR, LEONOR, AFRODITA I, SPAR, EVERSHINE |

|

YINGYU ENERGY |

9 |

Mal Blend, Oman and Urals |

13,011,671 |

OTARIA, AMAK, GLORY FOREVER, PHOENIX I, BERG 1, PALMER, NIERUS, TIFANI, ALTUS |

|

YUEYANG GUANSHENG |

9 |

Bitumen Blend and Fuel Oil |

12,878,186 |

AVITAL, LYDIA II, INNOVA, PALMER, SPIRIT OF CASPER, BERG 1, ELVA, FIONA, ARTEMIS III |

|

GUANGHUI KAINENG |

9 |

Mal Blend |

11,195,848 |

EVERSHINE, MEMPHIS, MS ANGIA, ATILA, IVY, LYDIA II, MARIANNE, SAVA |

|

XINYUE |

10 |

Crude and Mal Blend |

9,611,297 |

PALMER, ABYSS, QUEEN SERE,BRIGHT SONIA, MS ANGIA, PANDORA, GALAXY STAR, NYANTARA, OCEAN HERMANA |

|

KELIDA |

9 |

Crude, Oman, Iraq, Mal Blend and Nemina |

8,716,385 |

CLYDE NOBLE, EMILIA,INNOVA, LADY SOFIA, ANITA, ELVA, OTARIA, GULF VENTURE |

|

QIRUN |

7 |

Mal Blend |

8,410,923 |

PALMER, QUEEN SERE, VIGOR, SPAR, INNOVA, SPIRIT OF CASPER, SHALIMAR |

|

LUQING |

5 |

Mal Blend |

7,625,065 |

ANNICK, IONA, IRISES, MEHLE, SELENE |

|

DONGMING |

5 |

Fuel Oil,Mal Blend and Crude |

6,255,250 |

PALMER, ATILA, DIMITRA II, SPIRIT OF CASPER, OCEAN HERMANA |

|

MEIJIANENG |

5 |

Oman, Mal Blend and Bitumen Blend |

6,423,348 |

ELOISE, ACHELOUS, ISAIAH, SNOW LOTUS, ABYSS |

|

XIN RUI JI |

3 |

Mal Blend |

4,966,408 |

BOREAS, MUR, STATICE |

|

BANFU ENERGY |

3 |

Mal Blend, Nemina |

4,732,148 |

ANTHEA, ALANA |

|

ZHONGKANG/ZHONGYANG INTERNATIONAL |

2 |

Mal Blend & Fuel Oil |

4,003,824 |

IVY, ELYSIA |

|

HENGLI PETROCHEMICAL |

3 |

Crude |

3,982,379 |

HEBE, SCORPIUS, GALAXY STAR |

|

FURONGKANG |

3 |

Crude, Oman & Mal Blend |

3,804,369 |

IVY, BRIGHT SONIA, FIONA |

|

QICHENG |

3 |

Oman, Bitumen Blend, Malaysia Blend |

3,350,672 |

PANDORA, INNOVA, YANNIS |

|

YINGKE |

3 |

Fuel Oil & Mal Blend |

3,215,930 |

LADY LUCY, ROMA, ANNICK |

|

HANKUN ENERGY |

2 |

Light Crude and Malaysian Blend |

3,141,882 |

ALANA, PHONIX |

|

GANGRUN |

2 |

NEMINA |

3,096,726 |

MEMPHIS, ACHELOUS |

|

HAIKE |

3 |

Mal Blend |

3,076,029 |

PANDORA, ANNICK |

|

LITU FENGYUAN |

2 |

Mal Blend |

2,978,665 |

SERENE 1, KASPER |

|

YEUYANG GUANSHENG |

2 |

Bitumen Blend and Mal Blend |

2,974,386 |

HORNET, LEONOR |

|

XINRUN INTERNATIONAL |

2 |

Mal Blend |

2,945,139 |

PANDORA |

|

OCEANIC |

5 |

Bitumen Blend, TBA |

2,923,916 |

PHOENIX I, DOLPHIN, INGRID, TELSA |

|

HAIWANGDA |

2 |

Bitumen Blend, Mal Blend |

2,651,910 |

BRIGHT SONIA, IVY |

|

HUAJIN XIANGRUN |

4 |

Mal Blend |

2,639,642 |

PHOENIX I, PABLO , MARTINA, ROMA |

|

XINCHI |

2 |

Bitumen Blend and Fujairah |

2,221,568 |

SKADI, NESS |

|

XINRUIJI |

1 |

Mal Blend |

2,083,670 |

BELLA 1 |

|

CHANGFENG |

1 |

Mal Blend |

2,042,323 |

PUTRI SAMUDRA |

|

SAIDI |

1 |

Fujairah Blend |

2,042,266 |

VIRGO |

|

CISM |

1 |

Mal Blend |

2,012,558 |

PENTA I |

|

QINGHANG ENERGY |

1 |

Fujairah |

2,007,772 |

PAPA |

|

XIANNENG |

1 |

Bitumen Blend |

1,999,219 |

SCORPIUS |

|

GUANGDONG HONGHANG |

1 |

Crude |

1,994,565 |

PAPA |

|

QINGGANG QULIU |

1 |

Mal Blend |

1,980,791 |

ANNICK |

|

ZHONGYOU YIHAI |

1 |

Fuel Oil |

1,972, 160 |

WIN WIN |

|

LZVHOU |

1 |

Mal Blend |

1,921,461 |

ABUNDANCE III |

|

HAO KUN |

1 |

Bitumen Blend |

1,921,423 |

PENTA I |

|

YATAI ENERGY |

1 |

Malaysian Blend |

1,919,096 |

SELENE |

|

QINGAO KERUI |

1 |

Bitumen Blend |

1,907,070 |

VIGOR |

|

ZHONGLIAN HARUI |

1 |

Malaysian Blend |

1,856,190 |

DUPLIC DYNAMIC |

|

KAIDING |

1 |

Crude |

1,843,156 |

BOREAS |

|

HUAYOU |

2 |

Mal Blend and Crude |

1,810,641 |

EVERSHINE, DOLPHIN |

|

SINOCHEM CHANGHE |

2 |

Bitumen Blend, Oman |

1,722,944 |

BERG 1, EVERSHINE |

|

DAQI CHEMICAL |

2 |

Condensate and Crude |

1,609,034 |

TOMIE, NARCISSUS |

|

ZHONGYOU RUNHAI |

2 |

Mal Blend |

1,575,234 |

IVY, CHOLA QUEEN |

|

GAIDA |

2 |

Crude |

1,534,340

|

ELOISE, FENG TAI |

|

XINZHUOYUE |

2 |

TBA |

1,501,419 |

ANASTASIA I, BRIGHT SONIA |

|

YISHENGXIANG |

1 |

Mal Blend |

1,501,419 |

NIERUS |

|

DINGQIAN |

2 |

Bitumen Blend and Mal Blend |

1,468,1133 |

NYANTARA,OCEAN HERMANA |

|

OCEAN PARK |

2 |

Mal Blend, Nemina |

1,377,266 |

ALANA, PHOENIX I |

|

DAOYANG |

2 |

Bitumen Blend |

1,136,828 |

CIMARRON, SPAR |

|

CHAMBROAD |

2 |

Bitumen Blend |

1,291,249 |

EVERSHINE , BRIGHT SONIA |

|

RONGHAI |

2 |

Crude, Mal Blend |

1,228,102 |

COLOSSUS, SAMSUN |

|

HEBEI XINHAI |

2 |

Crude & Mal Blend |

1,240,603 |

PABLO,URGANE I |

|

YINGJIRUI |

1 |

Nemina |

1,125,532 |

MEMPHIS |

|

TAIFENG HAIRUN |

2 |

Crude |

1,104,875 |

DOLPHIN, PRADA |

|

QINGYUAN |

2 |

Nemina |

1,093,771 |

MEMPHIS |

|

ZHEJIANG WUCHAN |

1 |

Bitumen Blend |

1,078,153 |

MEMPHIS |

|

JULI |

1 |

Mal Blend |

1,065,341 |

GLORY FOREVER |

|

KAIYI PETROCHEMICAL |

1 |

Bitumen Blend |

1,035, 729 |

SPAR |

|

RUNCHENG |

2 |

Bitumen Blend |

1,034,667 |

TALOSA, HORNET |

|

ZHONGCHEN |

1 |

Bitumen Blend |

1,014,631 |

GABRIELLE |

|

HENGFENG |

1 |

Mal Blend |

973,389 |

INNOVA |

|

HAIRUN SHENGDE |

2 |

Bitumen Blend and Mal Blend |

1,731,354 |

TIBURTINA, NYANTARA |

|

DONGYING HONGXIANG |

1 |

Mal Blend |

935084 |

AYDEN |

|

GUANGJIN SHUNHE |

2 |

Bitumen Blend |

848,326 |

MARTINA, RANI |

|

WANTONG |

1 |

Crude |

842,920 |

CRESTED |

|

DINGYI |

1 |

Oman |

740,349 |

ALBA SUN |

|

HAIYUE ENERGY |

1 |

Mal Blend |

737,437 |

NYANTARA |

|

SHENGJU YUAN |

1 |

Bitumen Blend |

726,864 |

MARTINA |

|

JINAN ZONGBAO |

1 |

Bitumen Blend |

723,421 |

HERMOSA |

|

LIANRUN |

1 |

Mal Blend |

722,780 |

PHOENIX I |

|

HUANHAI ENERGY |

1 |

Singma |

719,500 |

GULF VENTURE |

|

YUANTONG ZHENGDAO |

1 |

Mal Blend |

718,064 |

ABYSS |

|

CGN |

1 |

Mal Blend |

717,867 |

CLYDE NOBLE |

|

SHILONG |

1 |

Crude |

711,301 |

NYANTARA |

|

BEI ANG SI |

1 |

Mal Blend |

703,286 |

HESTIA |

|

ZHOUSHAN JIAOTOU |

1 |

Bitumen Blend |

691,500 |

GULF VENTURE |

|

HANYUAN ENERGY |

1 |

Crude |

684,399 |

URGANE I |

|

XINHAN |

1 |

Crude |

609,009 |

ABYSS |

|

LIANHONG |

1 |

Condensate |

605,163 |

SUPER EVER |

|

ZHONGJIAO |

1 |

Crude |

512,117 |

JAKA TARUB |

|

SHANGNENG |

1 |

Bitumen Blend |

505,250 |

DOLPHIN |

|

GUANGZHOU RUBIO |

1 |

Mal Blend |

500,000 |

MS ANGIA |

|

HONGRUN |

1 |

Mal Blend |

496,900 |

CIMARRON |

|

EDEN |

1 |

Mal Blend |

419,403 |

DOLPHIN |

|

REMIS TRADING |

1 |

Oman |

265,900 |

AVENTUS I |

|

|

|

|

|

|

|

Total |

387 |

|

470,777,102 |

|

*reportedly not affiliated with Sinochem Holding

Receive Iran News in Your Inbox.

Eye on Iran is a news summary from United Against Nuclear Iran (UANI), a section 501(c)(3) organization. Eye on Iran is available to subscribers on a daily basis or weekly basis.